High Plains Tubular Company is a leading manufacturer and distributor of quality steel products used in energy, industrial, and automotive applications worldwide.

The U.S. steel industry has been challenged by competition from foreign producers located primarily in Asia. All of the U.S. producers are experiencing declining margins as labor costs continue to increase. In addition, the U.S. steel mills arc technologically inferior to the foreign competitors. Also, the U.S. producers have significant environmental issues that remain unresolved.

High Plains is not immune from the problems of the industry and is currently in technical default under its bond covenants. The default is a result of the failure to meet certain coverage and turnover ratios. Earlier this year, High Plains and its bondholders entered into an agreement that will allow High Plains time to become compliant with the covenants. If High Plains is not in compliance by year end, the bondholders can immediately accelerate the maturity date of the bonds. In this case. High Plains would have no choice but to file bankruptcy.

High Plains follows U.S. GAAP. For the year ended 2008, High Plains received an unqualified opinion from its independent auditor. However, the auditor's opinion included an explanatory paragraph about High Plains' inability to continue as a going concern in the event its bonds remain in technical default.

At the end of 2008, High Plains' Chief Executive Officer (CEO) and Chief Financial Officer (CFO) filed the necessary certifications required by the Securities and Exchange Commission (SEC).

To get a better understanding of High Plains' financial situation, it is helpful to review High Plains' cash flow statement found in Exhibit 1 and selected financial footnotes found in Exhibit 2.

Exhibit 2: Selected Financial Footnotes

1. During 2008, High Plains' sales increased 27% over 2007. Its sales growth continues to significantly exceed the industry average. Sales are recognized when a firm order is received from the customer, the sales price is fixed and determinable, and collectability is reasonably assured.

2. The cost of inventories is determined using the last-in, first-out (LIFO) method. Had the first-in, first-out method been used, inventories would have been $152 million and $143 million higher as of December 31,2008 and 2007, respectively.

3. Effective January 1, 2008, High Plains changed its depreciation method from the double- declining balance method to the straight-line method in order to be more comparable with the accounting practices of other firms within its industry. The change was not retroactively applied and only affects assets that were acquired on or after January 1,2008.

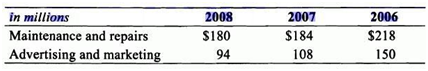

4. High Plains made the following discretionary expenditures for maintenance and repair of plant and equipment and for advertising and marketing:

5. During the fiscal year ended December 31, 2008, High Plains sold $50 million of its accounts receivable, with recourse, to an unrelated entity. All of the receivables were still outstanding at year end.

6. High Plains conducts some of its operations in facilities leased under noncancelable capital leases. Certain leases include renewal options with provisions for increased lease payments during the renewal term.

7. High Plains' average net operating assets at the end of 2008 and 2007 was $977.89 million and $642.83 million, respectively.

Which of the following is least likely to prevent earnings manipulation?

- The independent audit.

- SEC certification filed by High Plains' CEO and CFO.

- High Plains' bond covenants.

Answer(s): C

Explanation:

Bond covenants can create an incentive to engage in earnings manipulation. If High Plains remains non-compliant, the bondholders can demand immediate repayment of the debt. (Study Session 7, LOS 25.c)