Voyager Inc., a primarily internet-based media company, is buying The Daily, a media company with exposure to newspapers, television, and the internet.

Company Descriptions

Voyager Inc. is organized into two segments: Internet and Newspaper Publishing. The internet segment operates Web sites that offer news, entertainment, and advertising content in text and video format. The internet segment represents 75% of the company's total revenues. The newspaper publishing segment publishes 10 daily newspapers. The newspaper publishing segment represents 25% of the company's total revenues.

The Daily is organized into three segments: Newspaper Publishing (60% of revenues), Broadcasting (35% of revenues), and Internet (5% of revenues). The newspaper publishing segment publishes 101 daily newspapers. The Broadcasting segment owns and operates 25 television stations. The Internet segment consists of an internet advertising service. The Daily's newspaper publishing and broadcasting segments cover the twenty largest markets in the United States.

Voyager's acquisition of The Daily is The company's second major acquisition in its history. The previous acquisition was at the height of the merger boom in the year 2000. Voyager purchased the Dragon Company at a premium to net asset value, thereby doubling the company's size. Voyager used the pooling method to account for the acquisition of Dragon; however, because of FASB changes to the Business Combination Standard, Voyager will use the acquisition method to account for the Daily acquisition.

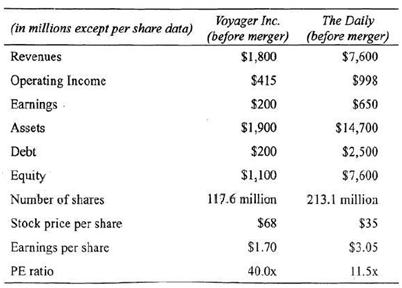

Voyager has made an all-cash offer of $45 per share to acquire The Daily. Wall Street is skeptical about the merger. While Voyager has been growing its revenues by 40% per year, The Daily's revenue growth has been less than 2% per year. Michael Renner. the CFO of Voyager, defends the acquisition by stating that The Daily has accumulated a large amount of tax losses and that the combined company can benefit by immediately increasing net income after the merger. In addition, Renner states that the New Voyager will eliminate the inefficiencies of the internet operations and thereby boost future earnings. Renner believes that the merged companies will have a value of $17.5 billion.

In the past, The Daily's management has publicly stated its opposition to merging with any company, a position management still maintains. As a result of this situation, Voyager submitted their merger proposal directly to The Daily's board of directors, while the firm's CEO was on vacation. Upon returning from vacation, The Daily's CEO issued a public statement claiming that the proposed merger was unacceptable under any circumstances.

Assume that Voyager offers 63 million shares of its stock, rather than cash, to acquire The Daily. The share price of the combined company is closest to:

- $145 per share.

- $150 per share.

- $155 per share.

Answer(s): B

Explanation:

total shares = 63.0 + 117.6 = 180.6 million

= 7,996.8 + 7,458.5 + 11,634.2 - 0 = 27,089.5

= 7,996.8 + 7,458.5 + 11,634.2 - 0 = 27,089.5

new share price = 27,089.5 / 180.6 = 150.0 (Study Session 9, LOS 31,.l,m)